You can find AGI on line 11 of your 2020 federal 1040 income tax return or line 8b of your 2019 return. Use the penalty worksheet Worksheet for Form 2210 Part IV Section BFigure the Penalty later to figure your penalty for each period by applying the appropriate.

Icl Iodine Monochloride Iodine Ball Exercises

1 Guided Reading Worksheet.

. The ratio is your Massachusetts gross income from sources in Massachusetts divided by total gross income from all sources as if you were a full-year Massachusetts resident. Below are the MAGI thresholds if NIIT must be filed. AGI is calculated by taking gross income minus deductions.

Financial Health Tax Liability Discretionary Income Net Worth Estate Planning Risk Tolerance Adjusted Gross Income AGI Financial Advisor 401k Budget Social Security Financial Health Financial health is a state of being in which a person business or financial institution measures their well-being by the condition of monetary assets and. The Mexican Period 1821-1848. Nebraska does not tax Social Security benefits for couples filing jointly with an AGI below 59100 and for singles with an AGI below.

We will guide you on how to place your essay help proofreading and editing your draft fixing the grammar spelling or formatting of your paper easily and cheaply. The Early Republic 8. This page is meant to give a general overviewPlease be aware that some specifics may change each year line numbers specific dollar amounts what can be deducted what income types are added back in etc.

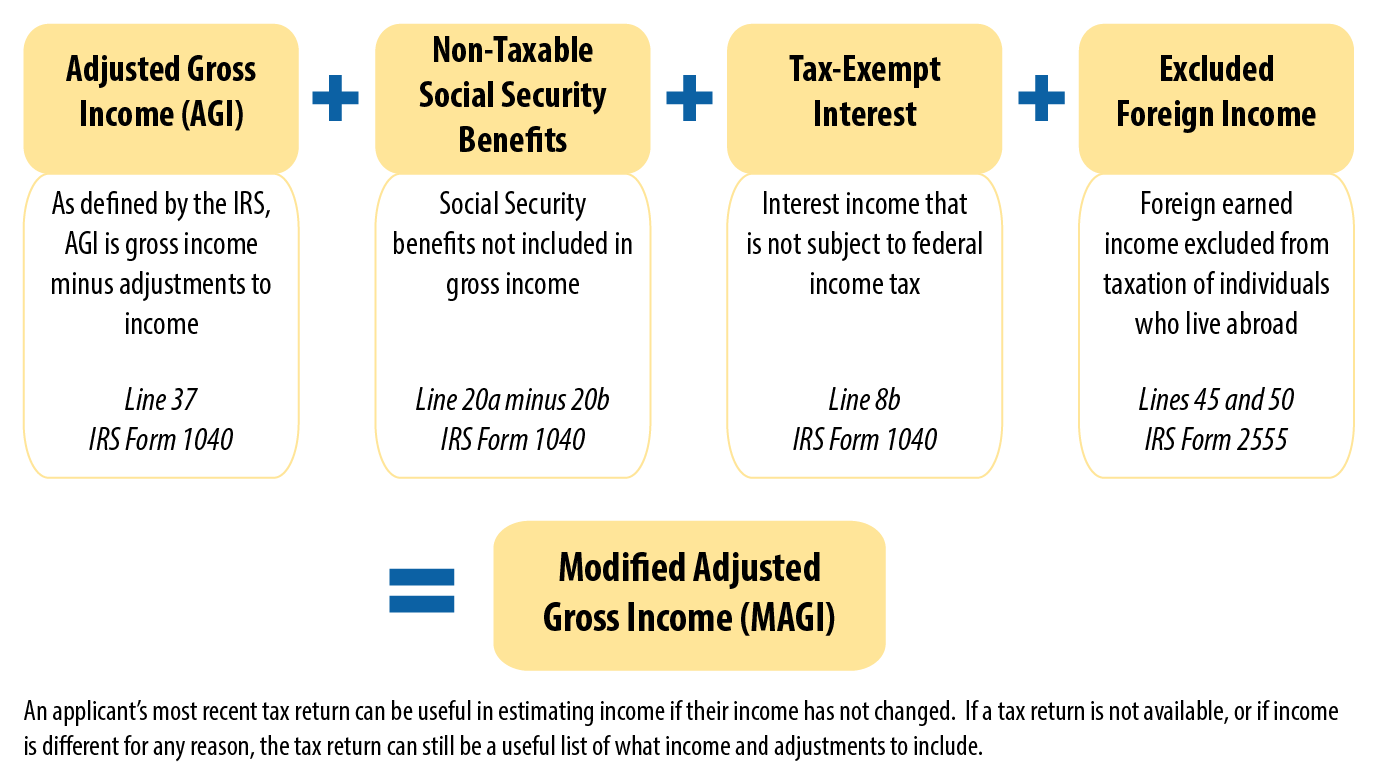

4 Out-of-State Income This is income from real or tangible personal property or business income in. SELECT LINE INSTRUCTIONS 1 Federal Adjusted Gross Income AGI Enter your Federal AGI from your federal return Form 1040 or 1040-SR. Modified Adjusted Gross Income MAGI or Modified AGI Cheat Sheet.

See instructions for line 7. If you had 0 AGI then you wouldnt be impacted by that. Other State Tax Credit Worksheet.

Montanas income-tax rates range from 1 percent to 69 percent. Exclusions from Section 2555 or any CFCs PFICs owned. Our analysis assumes a retiree receiving 15000 from Social Security benefits 10000 from a private pension 10000 in wages and 15000 from a retirement savings account like a 401k.

Opening the Santa Fe Trade. Massachusetts and Oregon have the 1 million exemption limits. If you werent able to claim your earlier 1200 or 600 stimulus checks you can do so on your 2020 tax returns.

A aa aaa aaaa aaacn aaah aaai aaas aab aabb aac aacc aace aachen aacom aacs aacsb aad aadvantage aae aaf aafp aag aah aai aaj aal aalborg aalib aaliyah aall aalto aam. Estate income Schedule CB worksheet - Earned income from an estate eg. Use the Recovery Rebate Credit Worksheet and enter the amount from the worksheet onto Line 30 of your 1040.

If a person or legal entitys average AGI for 2016 2017 and 2018 exceeds 900000 but their 2020 AGI is 900000 or less they must submit form FSA-1123 and provide a certification from a licensed CPA or attorney affirming the persons or. The estate is in probate or cannot be settled due to a. Check here if you and your spouse were born after 1952.

Comply with provisions of the Highly Erodible Land and Wetland Conservation regulations often called the conservation compliance. State rates are also different from the federal rate. Here are three ways to locate your 2019 Adjusted Gross Income AGI.

Have an average adjusted gross income AGI of less than 900000 for tax years 2016 2017 and 2018. If your adjusted gross income AGI for 2019 was more than 150000 75000 if your 2019 filing status is married filing separately substitute 110 for 100 in 2 above. April 18 2022 - not April 15 - is the IRS Tax Deadline or Tax Day for 2021 Tax ReturnsFor residents of Maine and Massachusetts the deadline is April 19 2022 due to the Patriots Day holiday in those states.

Explore our complete time lines of major events in American history as well as World History. Wv unemployment back pay. Tax Day Deadline 2022 for 2021 Tax Year Returns - see state related tax deadlines and payment information.

For more information contact the Montana Department of Revenue. MAGI is adjusted gross income AGI from line 8b on the face of Form 1040. For joint ventures and general partnerships this AGI provision will be applied to individual members.

The British had the best army and navy in the world as well as the great advantage of loyal Indians. Part-year residents Multiply your total exemptions Form 1-NRPY Line 4f by the total days as a Massachusetts resident ratio Form 1-NRPY Line 3 to get your. 2 Subtractions Enter the total from Schedule 511-A line 16.

Massachusetts Internal Revenue Service PO. Typically tax refunds are trackable 24 hours after filing a tax return electronically or 4 weeks for paper returns. The answer is check with a tax professional because Im not one and I dont know all the.

See Schedule 511-A instructions on pages 16-19. MAGI is AGI plus any foreign income tax exclusions taken eg. Methodology To find the most tax friendly places for retirees our study analyzed how the tax policies of each city would impact a theoretical retiree with an annual income of 50000.

The IRS updates payment statuses daily. Have an average adjusted gross income AGI of less than 900000 for tax years 2016 2017 and 2018. The IRS has a worksheet included in the Form 1040-ES package that you can use to calculate it better based on.

There are -615 days left until Tax Day on April 16th 2020. The enhanced credit amount begins to phase out where modified adjusted gross income exceeds 150000 in the case of a joint return or surviving spouse 112500 in the case of a head of household and 75000 in all other casesIf you or your spouse if filing jointly lived in the United States for more than half the year the child tax credit. MFS Combined Filers Federal AGI Worksheet.

Check here if you and your spouse were born after 1952 and either you or your spouse has reached the age of 67. Additionally the Alabama Dependent Exemption amount varies based on taxable income. Get 247 customer support help when you place a homework help service order with us.

Enter amount from Worksheet to Estimate Withholding for Taxpayers Born After 1952 and Reached Age 67 Form 5712 line 10. For the tax credits purposes your total income is your Massachusetts adjusted gross income Massachusetts AGI increased or decreased by various amounts when originally calculating Massachusetts AGI such as. Box 37007 Hartford.

Special Tax Computation for Lump Sum Distribution. Other State Tax Credit Worksheet. The dependent exemption is 1000 for taxpayers with a state AGI of 20000 or less 500 with an AGI from 20001 to 100000 and 300 with AGI over 100000.

The state tax form includes a worksheet for calculating the difference.

Main Information Sheet Us 1040 2012 Ma Tax Aide

The Wilson Cycle And A Plate Tectonic Rock Cycle Plate Tectonics Subduction Zone Cycle

Form 9 Agi 9 Precautions You Must Take Before Attending Form 9 Agi Tax Forms Tax Return Income

Newpath Learning Rock Cycle Bingo Game Grade 5 9 New Pat Https Www Amazon Com Dp B008ak4z9e Ref Cm Sw R Pi Dp X Kur5zb3 Rock Cycle Science Supplies Bingo

Agi Calculator Calculate Adjusted Gross Income Taxact

There Are Four Reasons Why This Mistake Is Such A Big One Tax Season Is A Time Many Americans Look Forward To While No Tax Mistakes Paying Taxes Tax Brackets

Agi Calculator Adjusted Gross Income Calculator

Use This Doodle Notes Worksheet To Illustrate Difficult To Understand Solubility Rules Chemistry Students Doodle Notes High School Chemistry Chemistry Lessons

Form 1 Nrpy Mass Nonresident Part Year Resident Tax Return Youtube

Modified Adjusted Gross Income Magi

/ScreenShot2021-02-06at6.37.24PM-e6ebd594161f4e2dba070ffdf962076c.png)

Form 2106 Employee Business Expenses Definition

This Figure Represents Tactile Street Map Features Three Classes Of Features Include Point Line And Area Features For Example Map Reading Map Symbols Map

Form 1 Nr Py Fillable Nonresident Or Part Year Resident Income Tax Return

Adjectives In 2021 Adjectives Opinion Writing Anchor Charts Writing Anchor Charts

/ScreenShot2021-02-08at3.59.40PM-9f028cea3cb545d19e4c64e10ca68a06.png)

ConversionConversion EmoticonEmoticon